Product Overview

Related Resources

Need More Information?

Get more information about our business and government services, or learn how your organisation can partner with Equifax.

To access your Personal Credit Report, visit https://www.equifax.co.uk

To query your Personal Credit Report or get help, visit https://help.equifax.co.uk/EquifaxOnlineHelp/s/

To access your business credit report, download our Business Report form and return your completed form to us via post or email using the information provided on the form.

Send an email to our customer service team via hello@equifax.com and we'll get in touch with you directly.

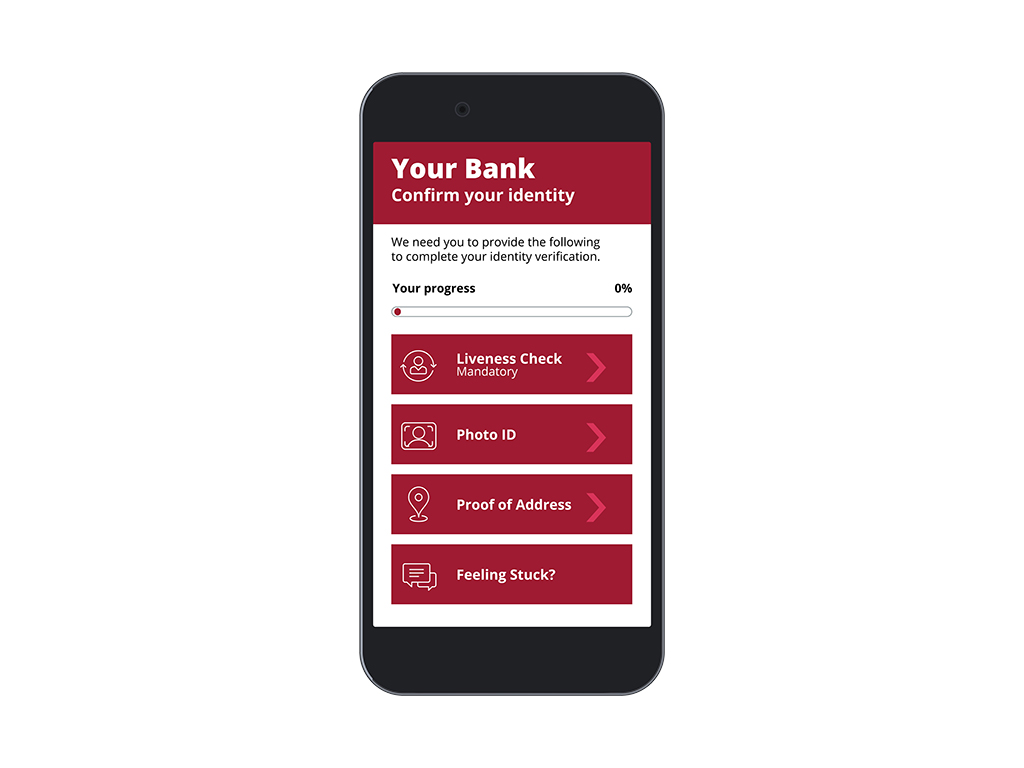

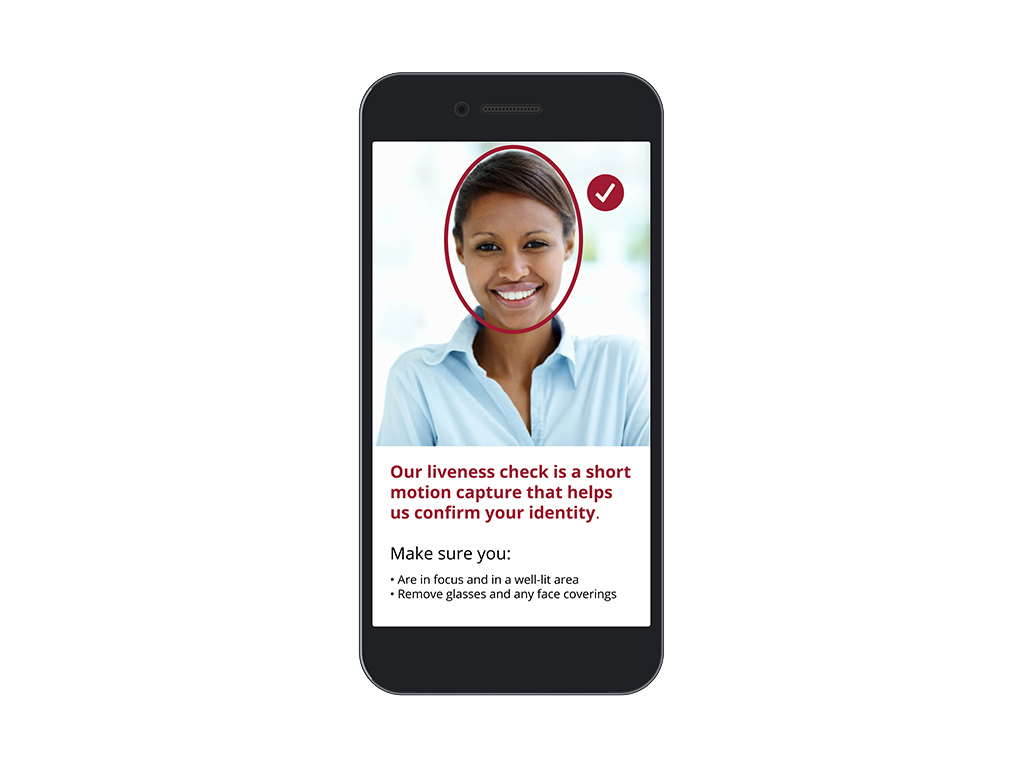

Using web or mobile camera facial scanning methods to check documents and identities, the software recognises over 6,000 global identification documents, including 200 international identity cards and passports. An efficient way of authenticating an identity with a high degree of assurance, it performs multiple, robust security checks, including machine-readable zone (MRZ), eChip, font, microprint and hologram verification, and facial recognition with passive liveness detection.

Fully customisable with four levels of validation; document, selfie, liveness and device, the user interface can integrate and aesthetically match your existing process. And we can add an auditing function to allow underwriters or administrators to review decisions and see why a consumer passed or failed.