Equifax consumer confidence index reveals dip in financial confidence post-Brexit

According to new data* from Equifax, the number of consumers feeling very confident about their finances fell to 44% in June 2016, down from 46% in May 2016. The new YouGov online research, which the credit information provider is conducting throughout 2016, also reveals that consumers are saving less.

Equifax has committed to conducting the YouGov research throughout the year to monitor trends in financial confidence as well as attitudes to savings. The second Quarterly Report reveals that in April 44% of individuals felt that on a scale of 0 to 10, they were “10 – very confident” – about their financial commitments. In May, this had risen to 46%, but in June consumers felt a bit more uncertain, with just 44% saying they were very confident about being able to afford their monthly commitments. This follows the same rise and fall of Quarter one.

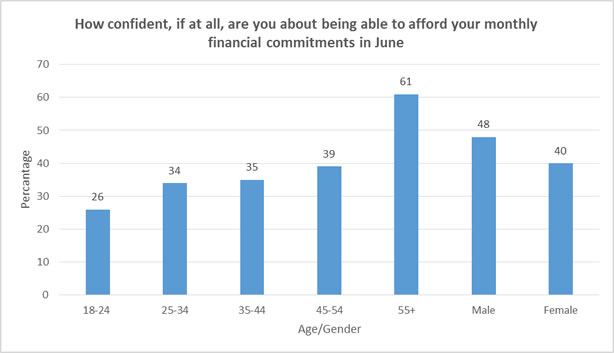

Throughout Quarter 2 the older generation remain the most confident about being able to afford their monthly financial commitments. Whilst consumer confidence in the 18-24 year olds dipped to its lowest in June to 26%, however they were the most credit active age group with 18 planning to take out some form of credit during the next month (i.e. July).

Men were consistently more confident about their financial commitments, with 48% of men being very confident, compared to just 40% of women, in June.

Pressure on Savings

Once again, the Equifax commissioned research reveals that consumers are struggling to save. In March nearly a third (31%) said they don’t save any money during an average month. The situation improved slightly in April with 28% saying they don’t save any money during in the average month. But in May the number of individuals not being able to save rose to 31% putting it above the levels in January and February 2016. In June however, this number fell again with only 29% saying they do not save any money in an average month.

When it comes to putting a little away for a rainy day, 45-54 year-olds are consistently least likely to save any money during an average month throughout quarter 2. In June, 37% of 45-54 year olds don’t save any money compared to just 26% of 18-25 year-olds, who are least likely to save anything during an average month.

Lisa Hardstaff, Equifax credit information expert, comments, “Consumer confidence continues to fluctuate from one month to the next but, post the EU referendum there was a drop compared to six months ago. And worryingly, many consumers are still failing to make any savings, which could leave them at risk of falling into debt if an unexpected bill comes in.

“In June, 10% of people surveyed said they are planning to take out some form of credit this year, which means it’s vital that they assess their current financial commitments as well as check their credit report before making any applications. That way they can be fully aware of the factors that may impact their ability to obtain the best deals.”

The Equifax Credit Report is accessible for 30 days free simply by logging onto www.equifax.co.uk/Products/credit/credit-score. If customers do not cancel before the end of the 30 Day Free Trial, the service will continue at £14.95 per month, giving them unlimited online access to their credit information and weekly alerts on any changes to their credit file. It also includes an online dispute facility to help them correct any errors on their credit file simply and quickly.

*Equifax Consumer Confidence Index- All figures, unless otherwise stated, are from YouGov Plc. The survey is run monthly to a total sample size of c.2050 adults. Fieldwork was undertaken in April, May and June 2016. The survey was carried out online. The figures have been weighted and are representative of all GB adults (aged 18+).

For further press information, please contact: Clare Watson, Cecile Stearn, Parm Heer or Wendy Harrison at HSL on 020 8977 9132 / Fax: 020 8977 5200 or Email: equifaxbtocteam@harrisonsadler.com

About Equifax

Equifax, Inc. (“Equifax”) powers the financial future of individuals and organizations around the world. Using the combined strength of unique trusted data, technology and innovative analytics, Equifax has grown from a consumer credit company into a leading provider of insights and knowledge that helps its customers make informed decisions. The company organizes, assimilates and analyses data on more than 800 million consumers and more than 88 million businesses worldwide, and its databases include employee data contributed from more than 5,000 employers.

Headquartered in Atlanta, Ga., Equifax operates or has investments in 24 countries in North America, Central and South America, Europe and the Asia Pacific region. It is a member of Standard & Poor's (S&P) 500® Index, and its common stock is traded on the New York Stock Exchange (NYSE) under the symbol EFX. Equifax employs approximately 9,200 employees worldwide.

Some noteworthy achievements for the company include: Ranked 13 on the American Banker FinTech Forward list (2015); named a Top Technology Provider on the FinTech 100 list (2004-2015); named an InformationWeek Elite 100 Winner (2014-2015); named a Top Workplace by Atlanta Journal Constitution (2013-2015); named one of Fortune’s World’s Most Admired Companies (2011-2015); named one of Forbes’ World’s 100 Most Innovative Companies (2015). For more information, visit www.equifax.com

Equifax Limited is one of the Equifax group companies based in the UK.

Equifax Limited is authorised and regulated by the Financial Conduct Authority.