Press Releases

Use of Buy Now Pay Later hit an all-time high this Christmas, with shoppers set to increase usage in 2023

The latest BNPL Barometer from Equifax analyses data from 23,000+ who hold current accounts, and 2,000 consumer interviews, offering a detailed picture of Buy Now Pay Later (BNPL) behaviour in the UK.

-

A third of UK adults have now used BNPL.

-

4.1 million people used BNPL for the first time in 2022.

-

One in eight (13%) consumers have now used BNPL to pay for a meal or takeaway, and a similar number (12%) have used it to spread the cost of everyday consumables such as groceries or toiletries.

Over a third (34%) of UK shoppers have now used Buy Now Pay Later (BNPL) services to spread the cost of purchases (1), and thousands chose to use BNPL for the first time over the 2022 festive season. That’s according to the latest BNPL Barometer from Equifax, one of the UK’s big three credit reference agencies. The latest barometer reading reveals how the cost-of-living crisis and shifting shopping habits are influencing the use of high-cost short-term credit.

The payment deferral service allows customers to spread the cost of retail purchases over a number of weeks or months, often with no additional interest. The research found that one in three (34%) Brits have now used BNPL services, up from 26% in November 2021 (2), suggesting that 4.1 million (3) people chose to use the payment method for the first time in 2022.

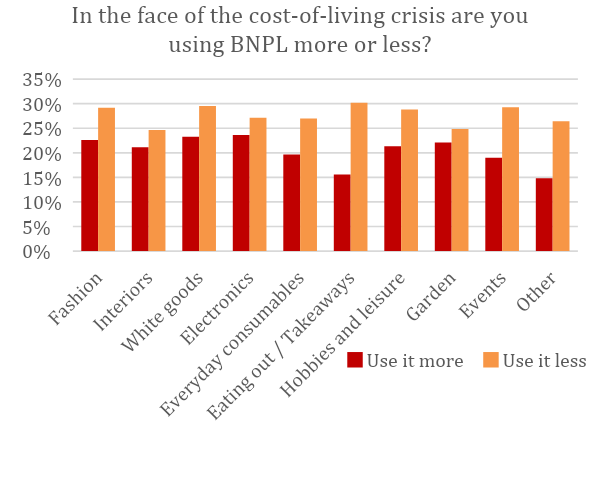

This year-on-year spike does not appear to be a consequence of the cost-of-living crisis. Equifax’s research found the opposite is true; and that across all major product categories, inflation is more likely to reduce BNPL spending than increase it.

December is traditionally the busiest month of the retail

calendar, and despite a slower than usual Black Friday period for

retail sales (4), Equifax’s study found that more than 1 in 10 (11%)

people expected to use BNPL for their Christmas shopping, and a

similar number (12%) will use it in the January sales. In fact, 38% of

this group say they would’ve struggled to afford Christmas without it.

It was a similar story in 2021 with 9% saying in November they would

rely on BNPL to cover at least some of their Christmas shopping.

Equifax reveals that in January last year, there were actually 15%

more shoppers making regular BNPL repayments than there were during

October 2021.- (5)

Jayadeep Nair, Chief Product and Marketing Officer at Equifax UK, said: “Buy now pay later has become a pervasive part of the shopping experience. As with any form of credit, when shoppers use it responsibly it can be a great budgeting tool to help manage extra spending over the festive period. As BNPL is a form of credit, it now appears within consumer credit reports, which can be viewed by lenders. This may impact lending decisions, therefore BNPL should be used with this in mind.”

“Shoppers do need to be wary of using BNPL to overstretch themselves especially if spending is being driven by wider social pressures.”

Equifax’s research indicated that those using BNPL the most over the festive included young people aged 18-34, a quarter (23%), and households earning between £60k and £90k per year (27%). This mirrors overall use of BNPL outside of the festive period, with more than half (55%) of 18-34 year-olds now saying they have used BNPL, and people in higher income households being far more likely to have used it than in the past (1).

Those of working age, earning a full-time income were more likely (15%) than those without it (12%) to use BNPL for Christmas shopping. This again parallels the overall use of BNPL across the year, which was at 34% and 42% respectively. (1)

Fashion (41%) and electronics (32%) remain the most popular product categories among BNPL users, who typically have higher value baskets when using this payment method. Consumers who used BNPL spent on average 58% more on fashion each month, and 69% more on discretionary items than those customers who did not use BNPL. (1)

There are however indications that BNPL is increasingly being used for lower value everyday items, which could be a sign of irresponsible use. One in eight (13%) consumers have now used BNPL to pay for a meal or takeaway, and a similar number (12%) have used it to spread the cost of everyday consumables such as groceries or toiletries. (1) The BNPL sector has invited scrutiny from the Treasury and FCA this year, but Equifax has not seen evidence of a significant increase in the average amount borrowed per individual.

Jayadeep Nair, Chief Product and Marketing Officer at Equifax UK, continued: “There’s little in our research to suggest that BNPL does more harm than good for UK consumers, but with more than four million people using it for the first time this year, it’s important that new users are aware of the risks of mismanaging their repayments.”

“Almost half (48%) of users report missing at least one payment in the past, and half (47%) of this population reporting being hit with extra fees as a result. Consumers will find missed BNPL payments appearing in their credit reports next year, so it’s vital that anyone using it sees it as the credit product that it is.”

ENDS

Methodology

Equifax analysed data from circa 23,600 customers over an 11-month period, between September 2021 and July 2022. This data was supplemented with the results of a nationally representative survey of 2,000 consumers conducted by Opinium between 2 December and 5 December 2022.

References

1 Reported BNPL use by 2,000 UK adults interviewed between Friday 2nd December and Monday 5th December 2022. All interviews were conducted by research agency Opinium for Equifax UK.

2 Reported BNPL use by 2,000 UK adults interviewed between 16th November and 18th November 2021. All interviews were conducted by research agency Opinium for Equifax UK.

3 Latest ONS estimate of UK adult population = 52,890,000

34% of national population = 17,797,485

26% of national population = 13,672,065

4 ONS Retail sales, Great Britain: November 2022. Seasonally adjusted retail sales volumes are estimated to have fallen by 0.4% in November 2022 following a rise of 0.9% in October. https://www.ons.gov.uk/businessindustryandtrade/retailindustry/bulletins/retailsales/november2022

5 Equifax analysed data from circa 23,600 customers over an 11-month period, between September 2021 and July 2022.